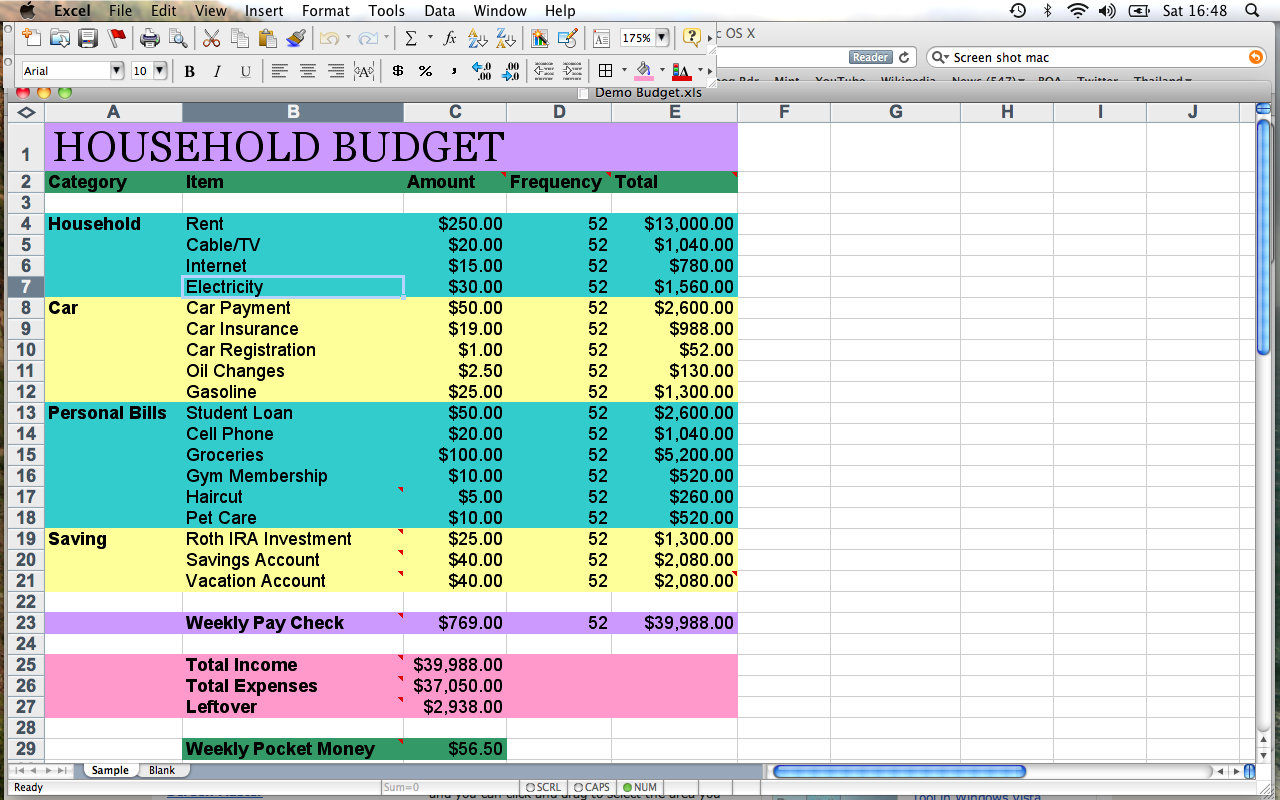

If you think having all this assigned to memory is too big an ask, try using Excel to make a budget worksheet. Having a clear understanding of the funds you bring in each month, and money you pay out is essential you can’t manage a budget if you don’t know what your budget actually is. You may think terms like “cash flow” and “expenses” are only used in the office, but being good with money is universal, whether you’re running a business or just making sure your family isn’t overspending. Introduce some of these budgeting tips into your home, to set a great example for your children and to make your life all the easier. Creating positive spending habits and running a personal budget are life skills everyone should know, including kids. Look at categories that are optional or luxuries to figure out where to make cuts.Whether you’re saving up for a sunny vacation or just counting the pennies for a rainy day, personal finance should always be top of mind when it comes to your household. If your totals are red at the end of any given month you will need assess where cuts in your spending must be made.

The actual numbers are updated as they happen.

It is important to manage income versus expenses on a monthly basis and limit the household to a budget. By downloading the Household Monthly Budget Template from, it is much easier to manage your hard earned money. Most people understand that they should be living off of a budget but doing this in your head will not be sufficient. This means that in the face of a family emergency, most households would not have an emergency fund to rely on. A majority of the US population lives paycheck to paycheck, meaning that many people are living beyond their means.

0 kommentar(er)

0 kommentar(er)